Overview

The extraordinary boost in mortgage production since 2020 has helped lenders achieve record levels of profitability. According to the Mortgage Bankers Association, lenders’ origination volumes were estimated to reach more than $3.99 trillion in 2021, driven by historically low interest rates. The volume of loan originations during 2020-2021 reached the highest levels in nearly 20 years, despite the challenges of the COVID-19 pandemic on the industry and consumers.

Today, as interest rates climb, lenders foresee a return to a more “normal” housing market. The mortgage industry expects lower demand for refinance activity and a shift more toward purchase activity among borrowers.

Recent research indicates that if a lender takes longer than 10 days to provide an application decision, a customer’s satisfaction drops by about 15 percentage points. Thus, the pressure for faster loan decisions has become immense.

Problem

PNC now faces increased competition by newer technology-focused players and tighter margins, in which they must drive cost effectiveness to remain competitive. The need to reimagine their business processes to increase speed to close, one of the highest in the industry, and to maximize operational efficiency has never been more urgent.

Approach

The combination of smart digital technology investments, the right partnerships, and well-planned implementation strategies are critical for addressing PNC’s business challenges. Adopting a holistic end-to-end approach with digital solutions that align to business goals is the most direct path to reducing inefficiencies and achieving greater processing speed, enhanced customer satisfaction and optimization across the loan origination process.

Business Goals

Spend $2,200 less per loan (operations)

Reduce the production cycle by 5 days

Achieve margins that are 1% higher

A Human-Centered Approach

Our team leveraged HCD methodologies together with a technology-agnostic mindset in our approach to examine the facility of existing processes and technologies and the overall experience of users. Applying a “human centered design” framework, we analyzed our research findings in collaborative working sessions to identify key pain points, gaps in productivity, and opportunities for an improved user experience.

Throughout a series of ten- to twelve-week strategy and design delivery engagements, my team collaborated with the PNC Mortgage Loan Coordination (Processing), Underwriting, and Back Office Support teams to gain a deep understanding of the entire mortgage loan process.

Our goal was to propose a future vision of a Mortgage Loan Origination solution that will sit over the existing Empower environment while using it as a system of record and at the same time also providing a custom user experience for each user group that addresses their needs.

-

Our goal was to envision a task-based tool that could streamline the processor’s current workflow and maximize productivity. We gathered feedback on design concepts and system interactions from stakeholders, and further refined our vision according to their input. After finalizing our UI concept artifacts, we created a detailed deliverable outlining the narrative for an ideal future state where a new software experience helps execute Processing more efficiently.

-

Our team conducted 20 focused interviews of key users to gather understanding, expertise, and insights on the Mortgage Loan Coordination process. We held collaborative working sessions to review and refine the current state of processing and the roles involved, focusing specifically on Loan Coordination (Processors) and Centralized Support. We mapped the user experience at a high level and highlighted workflow opportunities for Processing that will benefit users. After finalizing the current state processes and identifying the overarching themes for improvement, we presented our findings to stakeholders in the Insights Review. With the feedback that we captured, our group began imagining an ideal solution for mortgage loan coordinators.

Roles

My Role: Strategist & Team Lead

I oversaw three design pods while managing client relationship,

expectations, and vision.

UX/UI Senior Designer: Monica Payne

UX/UI Senior Designer: Ahmed Abdelrahman

UI Designer Ryan Fette

UI Designer: Timothy Kelly

UX Content Writer: Emily Massengale

UX Content Writer: Nathan Forshage

Execution

Strategy to Delivery Sprinting

The design pods that ran concurrently in staggered and overlapping timelines, starting with Strategy phases and then moving into Delivery phases for handoff to PNC’s Dev teams. We began with Processing first, then moved into Design Delivery while beginning work on the Strategy phase for Underwriting and Back Office. Design Delivery for those groups were then initiated and later picked up by the client to continue developing an MVP.

My design team worked with a Agile Scrum Master, client-side front-end development teams, product owners, business analysts, and tech and product executives.

PROCESSING

My team conducted stakeholder interviews, document review sessions with Mortgage Loan Coordination subject matter experts, and collaborative working sessions. These contextual inquiries and working sessions allowed the team to explore the disparate aspects of the mortgage process from various user perspectives, including both Retail and HLC/Refi Processors, the Centralized Support teams, and the two new roles created in the HLC Processing Redesign, the Customer Advocate and Back Office Support. My team also performed an audit of current official and unofficial tools used to complete processes. The audit allowed us to identify redundancies and overlap in existing systems.

User Group Profiles

My team conducted user interviews with individuals from 12 different areas of the Mortgage Loan Coordination process.

Personas

For our personas, we focused on the Retail Processor as the key role and also the Redesign roles, the Back Office Support team

and the Customer Advocate.

CURRENT STATE

Process Maps

Processors duplicate steps, use a manual process, and create redundancies and inconsistencies in their workflows.

SYNTHESIS

My team gathered this information through a series of focused interviews with individuals who interact with this process at some level in their regular workday, or whose work is directly affected by the results of the Loan Coordination process.

Many of the users that we interviewed shared their thoughts around each of the tasks that they performed throughout the day. Their main concerns centered around organizing and prioritizing their workload from start to finish.

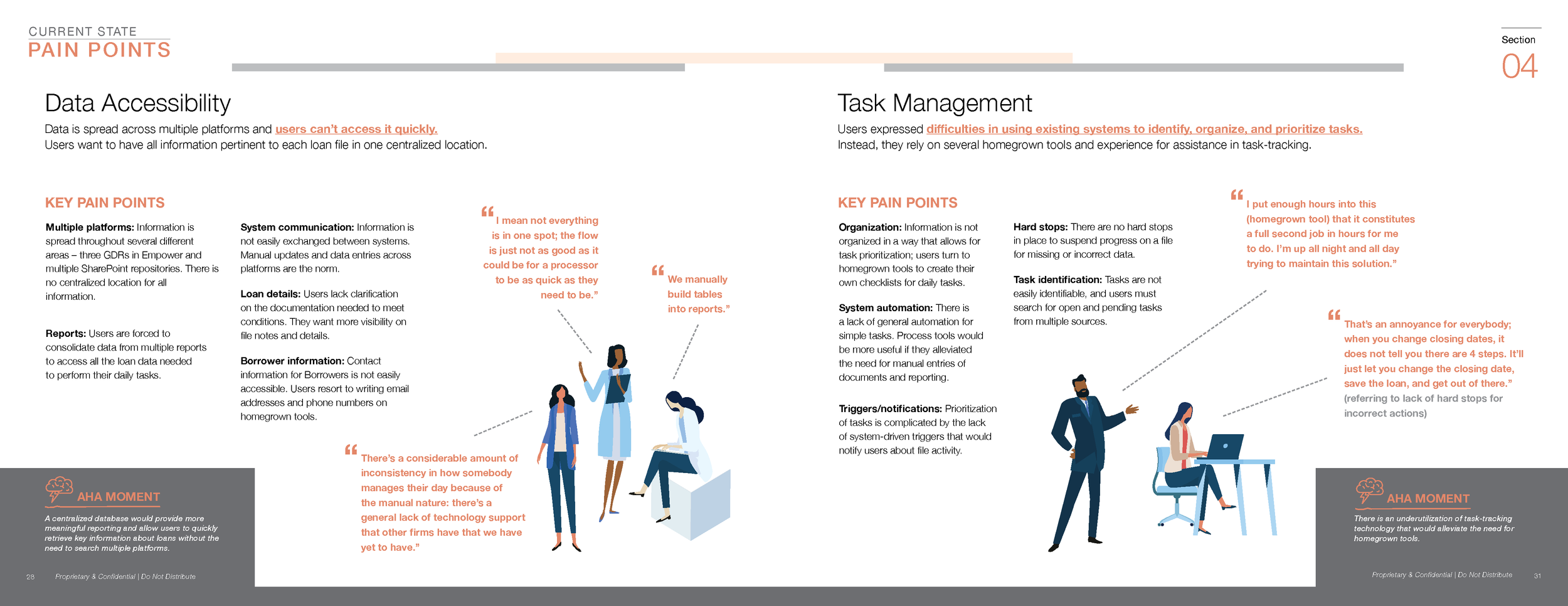

OVERARCHING THEMES & PAIN POINTS

Solution:

A Tool for Task Management

FUTURE STATE

Using the overarching themes as our guiding principles and the realization that Processors do not have a task management tool specifically for their work, my team envisioned an ideal task-based processing tool that can help alleviate the key pain points expressed by Processors and other key users. Our goal was to provide a more user-friendly, human-centered experience.

A new Underwriting tool should provide these features and benefits:

Easy to navigate single dashboard that provides a quick view of key loan information

Product-driven workflow that consolidates templates and calculators and accessing external resources in intuitive screen

Convenient viewing of detailed file information and associated documents at the correct time “Just enough, Just in time”

Task-management features that help with organization, prioritization, and storage for notes, documents, and condition

Elimination of redundant data entry through pre-populated fields and improved data transfer

Built-in hardstops, indicators, and notifications for improved usability

HiFi Screens

Design Mockups

My team designed an application to interact with PNC's Empower installation through Empower's APIs, Robotic Process Automation, and potentially custom-developed APIs. Our tool relies on its own separate data storage for its functionality. For example, it stores and retrieves task states, process connections, call scripts, session info, flags, and various other metadata to support the system.

Product Roadmap

Processing Roadmap

My team developed a proposed high level visual roadmap for PNC’s future state Mortgage Loan Coordination Processing implementation.

We partnered with PNC through the implementation journey to go deeper into front-end functionality and determine business needs such as process time targets, data flow, and business and technical requirements. Looking through a Human-Centered Design lens, we have focused on refining and maturing the process steps by validating the core concepts with the users to answer the issues from this experience.

Other Considerations

The following section outlines some initial considerations for implementation and possible solutions for further exploration that PNC should undertake before executing/implementing my team’s concept designs. They are based on the findings discovered during current state mapping.

Automation

With our new tool, we use automation technology to reduce manual input and increase process efficiency. Document parsing capabilities allow for speed and accuracy in an automated workflow, which decreases the redundancies in document review tasks.

We are providing a subset of this functionality to the Centralized Support team, which can also be designed as borrower-facing for later development of a self-service experience.

UI Design /Front-End Development

While the screens and artifacts my team created were intended to be consumed solely as mocked-up concepts, they were created in Figma (a multi-user design platform) using Ant Design (a mature UI component library) as an example and inspiration for the PNC to do further exploration with front-end development and design system adoption.

However the client liked them so much, they immediately began pre-production with their dev team before our initial engagement was even fully completed.

UNDERWRITING

Many of the users that we interviewed shared their thoughts around each of the tasks that they performed throughout the day. Their main concerns focused on streamlining their workflow and the number of external calculators and templates that are required.

CURRENT STATE

Solution:

A Product-Driven Workflow

FUTURE STATE

Using the overarching themes as our guiding principles and the realization that the work Underwriters do is centered around the different products they service, we have envisioned an ideal, product-driven workflow to help Underwriters reach decisions faster. While all Underwriters have similar duties, the intricacies of their work are determined by the products they handle (Wealth, Government, etc.). Our goal was to provide a more user-friendly, human-centered experience that is responsive to each Underwriter’s needs.

A new processing tool should provide these features and benefits:

Single dashboard that is easy to navigate and provides a quick view of key loan information

Intuitive screens that indicate next steps

Task-management features to help with organization, prioritization, and storage for personalized notes.

Easy viewing of more detailed file information and associated documents at any time

Ability to send internal and external communication

Seamless integration of forms, email templates, and scripts

Stop gaps that minimize incomplete or missing information

Automation of redundant, manual tasks

Design Mockups

The goal of this phase of the project was to provide a streamlined experience of the same Empower overlay, but this time it would need to be specific for Underwriters. My team outlined a more efficient use of existing tools and the incorporation of calculators and templates that currently reside outside Empower. This EMU platform will interact with PNC's Empower installation through Empower's APIs, Robotic Process Automation, and potentially custom-developed APIs.

BACK OFFICE SUPPORT

The same approach was carried out for Back Office Support.

Additionally, these efforts led to extensions to our engagement with this line of business at PNC and spun up strategy projects for an MLO Companion app as well as additional design delivery projects.